repository <- "data"Preparation: Growth forecasts and fiscal consolidation

For Session 10

This exercise focuses on estimating, manipulating and interpreting (simple) linear models. Prior exposure to Keynesian macroeconomics will help, but is not required.

Scenario

You are interning at the Financial Times (FT), under the auspices of Chris Giles.

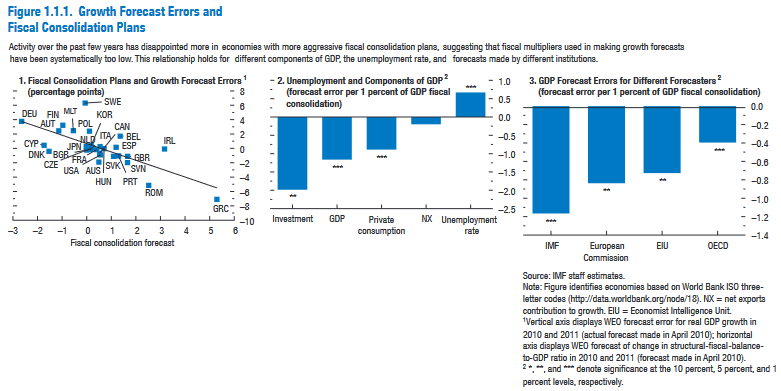

Giles has just released a story titled “Robustness of IMF data scrutinised” (October 12, 2012), in which he tries, and fails, to replicate some of the results published in the World Economic Outlook 2012 report of the International Monetary Fund (IMF).

Giles asks you to independently check that his calculations, which cast some doubt on Box 1.1 of the report (pp. 41–3, “Are We Underestimating Short-Term Fiscal Multipliers?”), are correct.

Instructions

Start by reading all relevant sources (at least those still available…) cited in the scenario above.

Then:

readxl::read_excel and dplyr::select

library(readxl)library(tidyverse) # {dplyr}, {ggplot2}, {readxl}, {stringr}, {tidyr}, etc.d <- readxl::read_excel(paste0(repository, "/IMFmultipliers.xlsx"), sheet = 2, skip = 2)New names:

• `` -> `...1`

• `GDP forecast` -> `GDP forecast...2`

• `` -> `...3`

• `` -> `...5`

• `` -> `...6`

• `` -> `...8`

• `` -> `...9`

• `GDP forecast` -> `GDP forecast...10`

• `` -> `...11`

• `` -> `...12`

• `` -> `...13`

• `` -> `...15`d <- d %>%

select(country = `...1`, Dgrowth, Dstruct, DCAPB, cadef = `CA Def`) countrycode::countrycode, dplyr::mutate, tidyr::drop_na and dplyr::filter

# take a look at the variable country

print(d %>% select(country), n = Inf)# A tibble: 49 × 1

country

<chr>

1 Australia

2 Austria

3 Belgium

4 Canada

5 Cyprus

6 Czech Republic

7 Denmark

8 Finland

9 France

10 Germany

11 Greece

12 Hong Kong SAR

13 Iceland

14 Ireland

15 Israel

16 Italy

17 Japan

18 Korea

19 Luxembourg

20 Malta

21 Netherlands

22 New Zealand

23 Norway

24 Portugal

25 Singapore

26 Slovak Republic

27 Slovenia

28 Spain

29 Sweden

30 Switzerland

31 Taiwan Province of China

32 United Kingdom

33 United States

34 <NA>

35 Albania

36 Bosnia and Herzegovina

37 Bulgaria

38 Croatia

39 Estonia

40 Hungary

41 Kosovo

42 Latvia

43 Lithuania

44 Former Yugoslav Republic of Macedonia

45 Montenegro

46 Poland

47 Romania

48 Serbia

49 Turkey # use countrycode to filter countries

d <- d %>%

mutate(

ccode = countrycode::countrycode(country, "country.name", "genc3c"),

# identify European countries

region = countrycode::countrycode(ccode, "genc3c", "region"),

eu = stringr::str_detect(region, "Europe") | ccode %in% "MLT",

# identify IMF country subset

imf_subset = eu | ccode %in% c("AUS", "CAN", "JPN", "KOR", "USA"),

# identify Chris Giles country subsets

giles_subset1 = !ccode %in% c("NZL", "DEU", "GRC"),

giles_subset2 = !ccode %in% c("DEU", "GRC")

) %>%

# drop empty (gap) row

tidyr::drop_na(country)

# create subsets

d_imf <- d %>% filter(imf_subset)

d_cg1 <- d %>% filter(giles_subset1)

d_cg2 <- d %>% filter(giles_subset2)plotting functions, mainly using ggplot2 : ggplot2::geom_point, ggrepel::geom_text_repel, ggplot2::geom_smooth and ggplot2::scale_x_continuous + ggplot2::scale_y_continuous

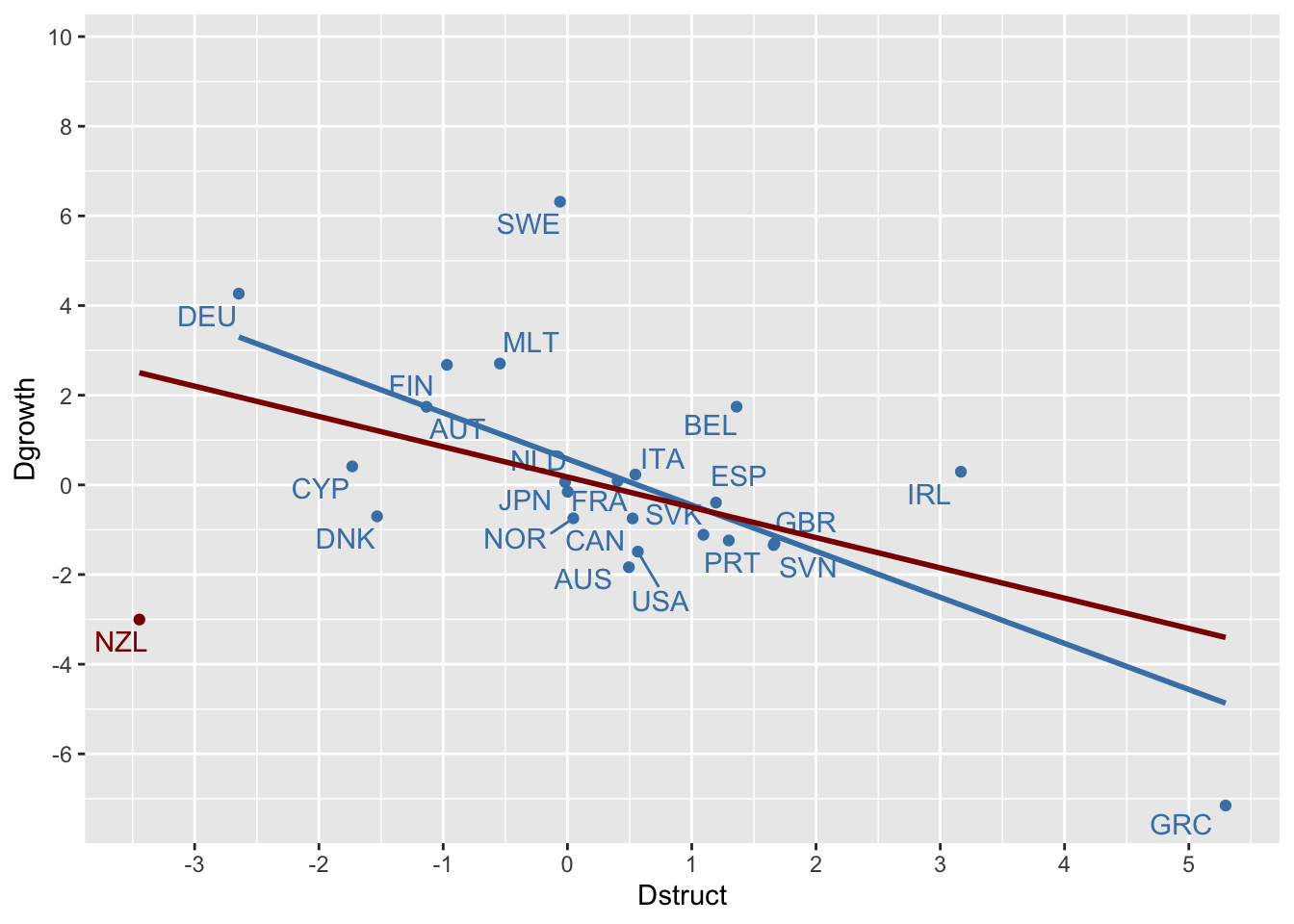

ggplot(data = NULL, mapping = aes(y = Dgrowth, x = Dstruct)) +

# 1. Points and associated labels

## IMF subset

geom_point(data = d_imf, color = "steelblue") +

ggrepel::geom_text_repel(data = d_imf, aes(label = ccode), color = "steelblue") +

## non IMF subset

geom_point(data = d %>% filter(!imf_subset), color = "darkred") +

ggrepel::geom_text_repel(data = d %>% filter(!imf_subset), aes(label = ccode), color = "darkred") +

# 2. Regressions

## IMF subset

geom_smooth(data = d_imf, method = "lm", se = FALSE, color = "steelblue") +

## All dataset

geom_smooth(data = d, method = "lm", se = FALSE, color = "darkred") +

# 3. Breaks : 1 unit for x, 2 units for y

scale_x_continuous(breaks = scales::breaks_width(1)) +

scale_y_continuous(breaks = scales::breaks_width(2))`geom_smooth()` using formula = 'y ~ x'Warning: Removed 20 rows containing non-finite outside the scale range

(`stat_smooth()`).`geom_smooth()` using formula = 'y ~ x'Warning: Removed 24 rows containing non-finite outside the scale range

(`stat_smooth()`).Warning: Removed 20 rows containing missing values or values outside the scale range

(`geom_point()`).Warning: Removed 20 rows containing missing values or values outside the scale range

(`geom_text_repel()`).Warning: Removed 4 rows containing missing values or values outside the scale range

(`geom_point()`).Warning: Removed 4 rows containing missing values or values outside the scale range

(`geom_text_repel()`).

- Regressions with

lm - Compare models with

texreg::screenreg - Goodness-of-fit (RMSE) with

performance::compare_performance

#library(broom)

library(performance)

library(texreg)# regression models

M1 <- lm(Dgrowth ~ Dstruct, data = d_imf)

M2 <- lm(Dgrowth ~ Dstruct, data = d)

M3 <- lm(Dgrowth ~ Dstruct, data = d_cg1)

M4 <- lm(Dgrowth ~ DCAPB, data = d)

M5 <- lm(Dgrowth ~ DCAPB, data = d_cg2)

M6 <- lm(Dgrowth ~ Dstruct + cadef, data = d)

M7 <- lm(Dgrowth ~ Dstruct + cadef, data = d_cg2)

m <- list(M1, M2, M3, M4, M5, M6, M7)

texreg::screenreg(m)

============================================================================

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7

----------------------------------------------------------------------------

(Intercept) 0.58 0.18 0.45 1.32 * 1.13 0.29 0.20

(0.42) (0.48) (0.43) (0.57) (0.61) (0.46) (0.44)

Dstruct -1.03 *** -0.68 * -0.52 -0.49 -0.01

(0.25) (0.27) (0.35) (0.27) (0.31)

DCAPB -0.60 * -0.31

(0.22) (0.34)

cadef 0.16 0.11

(0.09) (0.08)

----------------------------------------------------------------------------

R^2 0.45 0.23 0.10 0.18 0.03 0.33 0.08

Adj. R^2 0.42 0.19 0.06 0.16 -0.00 0.27 -0.02

Num. obs. 23 24 21 35 33 24 22

============================================================================

*** p < 0.001; ** p < 0.01; * p < 0.05# root mean squared error, as an alternative to R-squared

performance::compare_performance(m) %>%

select(Name, RMSE) %>%

arrange(RMSE)When comparing models, please note that probably not all models were fit

from same data.# Comparison of Model Performance Indices

Name | RMSE

---------------

Model 3 | 1.768

Model 1 | 1.854

Model 7 | 1.866

Model 6 | 2.059

Model 2 | 2.220

Model 4 | 3.034

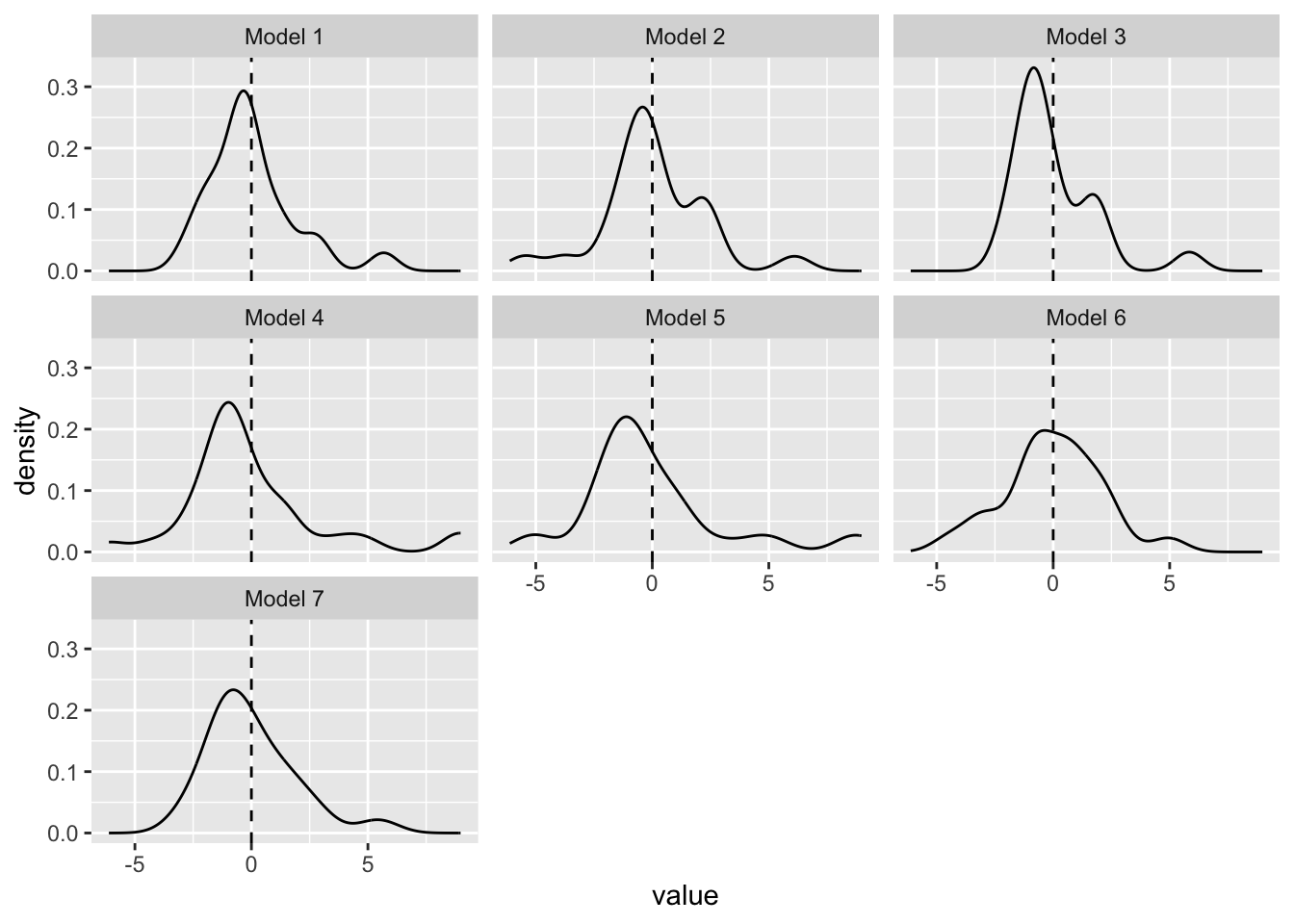

Model 5 | 3.061The RMSE has to be minimized, thus Model 3 seems to be the best.

The best RMSE are for IMF subset (European Union countries, plus Australia, Canada, Japan, Korea and the United States) and for Giles subset #1 (all countries except New Zealand, Germany and Greece). The worst RMSE are associated with the dataset of all countries and Giles subset #2 (all countries except Germany and Greece).

The IMF databases did not include data for Korea, Hungary, Romania, Bulgaria and Poland and while it did contain data for New Zealand, the country was not included even though Australia was. However, the RMSE are much worst when NZ (obvious outlier) is included. The correlation is much less robust without this outlier.

# dataset of residuals

data_resid = data.frame(

value = c(resid(M1),

resid(M2),

resid(M3),

resid(M4),

resid(M5),

resid(M6),

resid(M7)),

model = c(rep("Model 1", length(resid(M1))),

rep("Model 2", length(resid(M2))),

rep("Model 3", length(resid(M3))),

rep("Model 4", length(resid(M4))),

rep("Model 5", length(resid(M5))),

rep("Model 6", length(resid(M6))),

rep("Model 7", length(resid(M7)))

)

)

# residuals distributions

ggplot(data_resid, aes(x = value)) +

geom_density() +

# help assessing symmetry

geom_vline(xintercept = 0, lty = "dashed") +

facet_wrap(~ model)

# Advanced coding

purrr::map_dfr(m, ~ tibble::as_tibble_col(resid(.x)), .id = "model") %>%

mutate(model = str_c("Model ", model))

# quick explainer of how this is coded:

# 1. `map` allows you to apply a function, e.g. `resid`, to a list

map(m, ~ resid(.x))

# 2. you can convert the result of that function to a data frame column

map(m, ~ tibble::as_tibble_col(resid(.x)))

# 3. instead of `map`, use `purrr::map_dfr` to bind all those columns into one

purrr::map_dfr(m, ~ tibble::as_tibble_col(resid(.x)))

# 4. and since you need each series to be identifiable, give them an `.id`

purrr::map_dfr(m, ~ tibble::as_tibble_col(resid(.x)), .id = "model")Advanced questions [DON’T DO THEM]

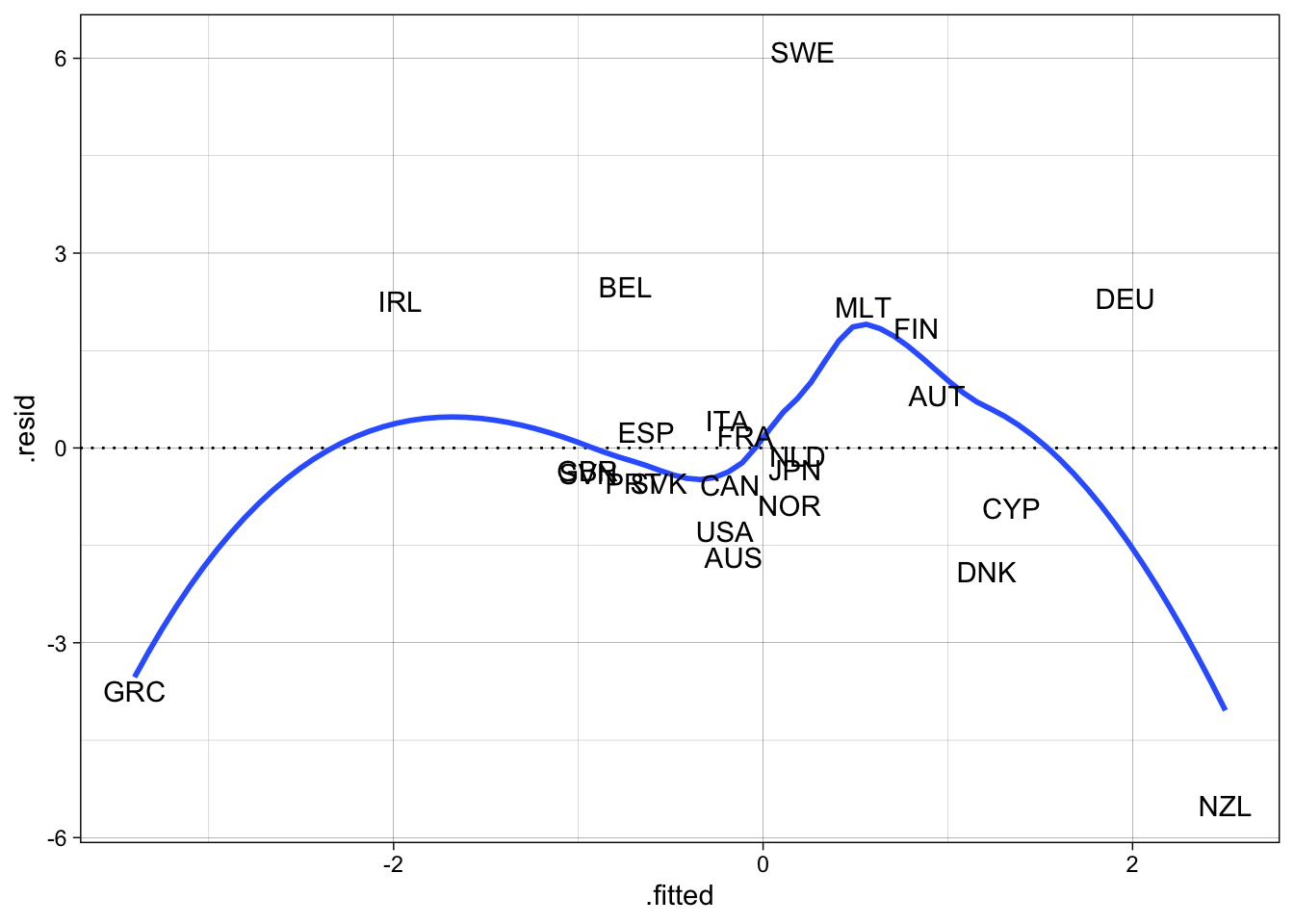

# residuals-versus-fitted values (Model 2)

broom::augment(M2, data = tidyr::drop_na(d, Dgrowth, Dstruct)) %>%

ggplot(aes(y = .resid, x = .fitted)) +

geom_hline(yintercept = 0, lty = "dotted") +

geom_smooth(se = FALSE) +

geom_text(aes(label = ccode)) +

theme_linedraw()`geom_smooth()` using method = 'loess' and formula = 'y ~ x'

# Cook's distance

broom::augment(M2, data = tidyr::drop_na(d, Dgrowth, Dstruct)) %>%

filter(.cooksd > 1) %>%

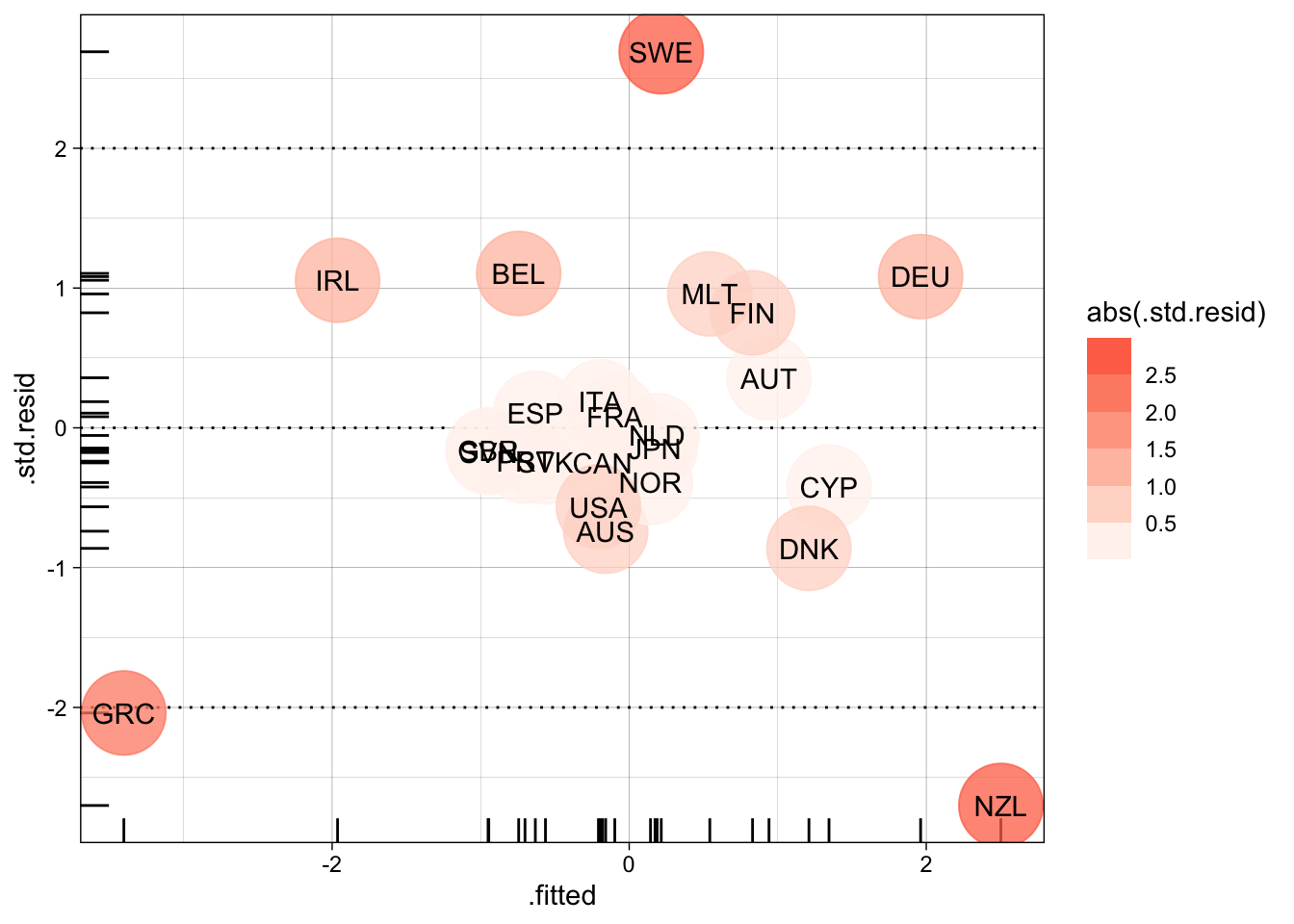

pull(country)[1] "Greece" "New Zealand"# standardized residuals

broom::augment(M2, data = tidyr::drop_na(d, Dgrowth, Dstruct)) %>%

filter(abs(.std.resid) > 2) %>%

pull(country)[1] "Greece" "New Zealand" "Sweden" # standardized residuals, visually

broom::augment(M2, data = tidyr::drop_na(d, Dgrowth, Dstruct)) %>%

ggplot(aes(y = .std.resid, x = .fitted)) +

geom_rug() +

geom_hline(yintercept = c(-2, 0, 2), lty = "dotted") +

geom_point(aes(color = abs(.std.resid)), size = 15, alpha = 3/4) +

geom_text(aes(label = ccode)) +

scale_color_binned(low = "white", high = "tomato") +

theme_linedraw()

repository <- "data"# replicate IMF effect size

imf <- readr::read_csv(paste0(repository,"/boxfig1_1_1.csv"), skip = 5) %>%

select(country = `...1`, growth = y, fiscal = `Fiscal consolidation forecast`)New names:

Rows: 28 Columns: 10

── Column specification

──────────────────────────────────────────────────────── Delimiter: "," chr

(4): ...1, Investment, ...8, IMF dbl (4): y, Fiscal consolidation forecast,

-1.987, -1.166122 lgl (2): ...4, ...5

ℹ Use `spec()` to retrieve the full column specification for this data. ℹ

Specify the column types or set `show_col_types = FALSE` to quiet this message.

• `` -> `...1`

• `` -> `...4`

• `` -> `...5`

• `` -> `...8`# published coefficient of -1.16

coef(lm(growth ~ fiscal, data = imf))[ "fiscal" ] fiscal

-1.164258 Source

The data in this folder come from a blog post by Chris Giles that seems not available online anymore:

Chris Giles, “Has the IMF proved multipliers are really large? (wonkish),” Money Supply, 12 October 2012.

However, an archived (and incomplete) version of the relevant blog post can be found at the Internet Archive.

Economics is the science of thinking in terms of models joined to the art of choosing models that are relevant to the contemporary world.

— John Maynard Keynes

To allow the market mechanism to be sole director of the fate of human beings and their natural environment, indeed, even of the amount and use of purchasing power, would result in the demolition of society.

— Karl Polanyi